In a significant move aimed at enhancing the financial well-being of its members, Pag-IBIG Fund has declared a substantial increase in mandatory monthly savings, doubling the savings and elevating cash loan entitlements. The adjustments are set to take effect from February 2024, bringing about positive changes for Pag-IBIG Fund members and their employers.

This move is not a sudden decision but stems from a strategic plan approved by the Pag-IBIG Fund Board of Trustees in 2019, with stakeholders' concurrence. The foresight in projecting the increase was driven by the agency's anticipation of a surge in loan disbursements potentially outpacing total collections from payments and savings.

The deferral of the rate increase in 2021 and 2022, in response to the challenges posed by the COVID-19 pandemic, showcases Pag-IBIG Fund's adaptive approach to external circumstances. The decision to postpone was a response to the Employers' Confederation of the Philippines' request, demonstrating a consideration for the broader economic landscape and the need for recovery time.

New Savings Rates: Doubling the Impact

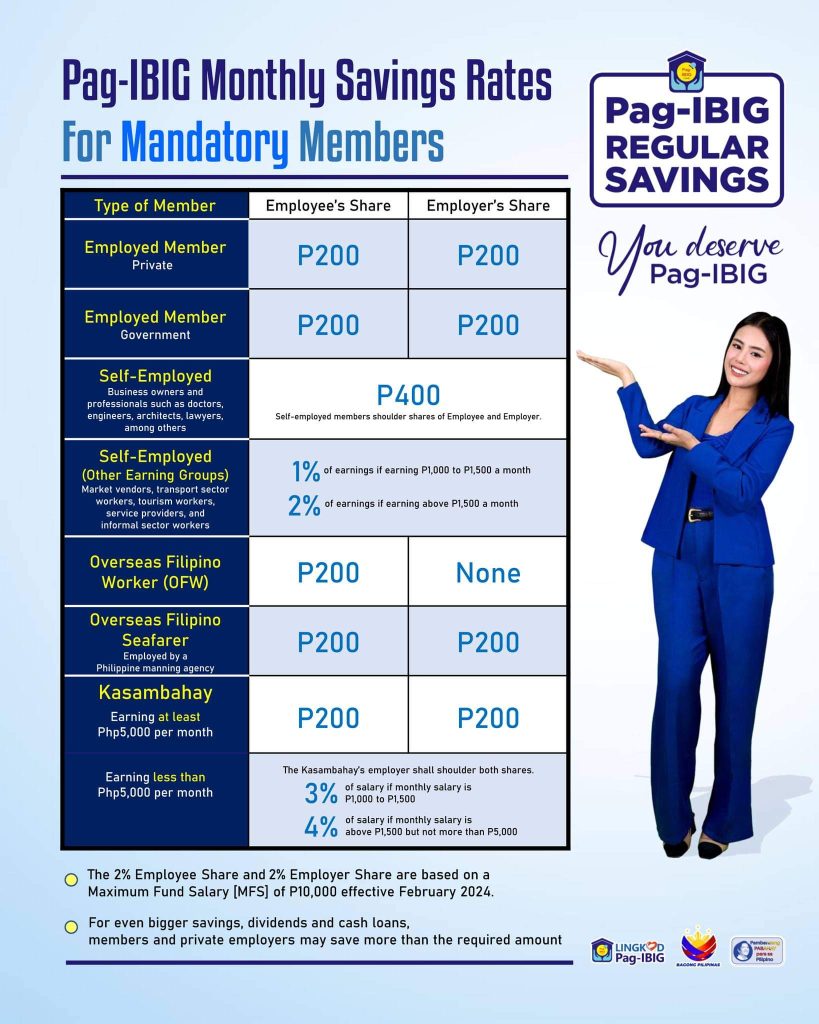

The new rates, as outlined in the official press release, highlight a doubling of monthly savings for both employees and employers. The employee's share and the employer's counterpart will see an increase from the current one hundred pesos (P100) to two hundred pesos (P200) each. This change aligns with the adjustment in the maximum monthly compensation used to calculate the required two percent (2%) employee savings and two percent (2%) employer share. The new threshold is set at ten thousand pesos (P10,000), up from the previous five thousand pesos (P5,000).

"We at Pag-IBIG Fund have long recognized the need for our members to build higher savings, ensuring decent returns upon retirement and facilitating increased cash loans during times of need," emphasized Secretary Jose Rizalino L. Acuzar, who heads the Department of Human Settlements and Urban Development (DHSUD) and the Pag-IBIG Fund Board of Trustees.

President Marcos, Jr.'s Vision: A Catalyst for Change

The move to implement these new rates, initially approved in 2019, is not just a response to projected increases in loan disbursements. It is a step towards fulfilling President Ferdinand Marcos, Jr.'s vision of providing Filipino workers with opportunities for comfortable and productive lives.

Despite the challenges brought on by the COVID-19 pandemic in 2021 and 2022, the Pag-IBIG Fund Board deferred the increase in savings rates. This decision was in response to the Employers' Confederation of the Philippines' request, allowing the business community time to recover from the ongoing financial challenges.

Stakeholder Support: A Driving Force

Stakeholder support, as acknowledged by Pag-IBIG Fund CEO Marilene C. Acosta, plays a pivotal role in realizing these changes. Recognition from key organizations such as the Trade Union Congress of the Philippines (TUCP), the Federation of Free Workers (FFW), and the Employers' Confederation of the Philippines (ECOP) signifies a collaborative effort towards the common goal of providing better financial opportunities for Pag-IBIG Fund members.

"Raising our monthly savings rates will allow Pag-IBIG Fund to continue providing affordable home loans to its members in the coming years," Acosta affirmed. She highlighted the direct benefits for members, emphasizing the potential for higher savings that earn annual dividends. For instance, a member saving under the new rates over 20 years could receive double the amount, leading to a substantial increase in multi-purpose and calamity loan entitlements.

As Pag-IBIG Fund gears up to implement these new rates, the focus remains on empowering members with enhanced financial benefits. The move not only aligns with the organization's commitment to supporting members but also reflects a collective effort to navigate the challenges posed by the pandemic. Stay tuned for updates on how these changes will positively impact your financial journey with Pag-IBIG Fund.